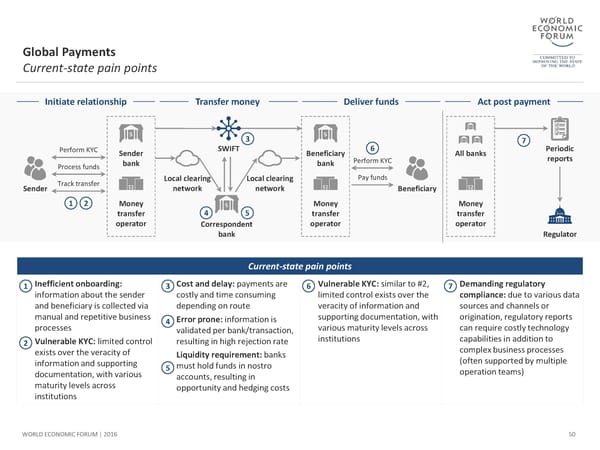

Global Payments Current-state pain points Initiate relationship Transfer money Deliver funds Actpost payment 3 7 Perform KYC Sender SWIFT Beneficiary 6 All banks Periodic bank bank Perform KYC reports Process funds Track transfer Local clearing Local clearing Pay funds Sender network network Beneficiary 1 2 Money Money Money transfer 4 5 transfer transfer operator Correspondent operator operator bank Regulator Current-state pain points 1 Inefficient onboarding: 3 Cost and delay: payments are 6 Vulnerable KYC: similar to #2, 7 Demanding regulatory information aboutthe sender costly and time consuming limited control exists over the compliance: due to various data and beneficiary is collected via depending on route veracity of information and sources and channels or manual and repetitive business 4 Error prone: information is supporting documentation, with origination, regulatory reports processes validated per bank/transaction, various maturity levels across can require costly technology 2 Vulnerable KYC: limited control resulting in high rejection rate institutions capabilities in addition to exists over the veracity of Liquidity requirement: banks complex business processes information and supporting 5 must hold funds in nostro (often supported by multiple documentation, with various accounts, resulting in operation teams) maturity levels across opportunity and hedging costs institutions WORLD ECONOMIC FORUM | 2016 50

The Future of Financial Infrastructure Page 49 Page 51

The Future of Financial Infrastructure Page 49 Page 51