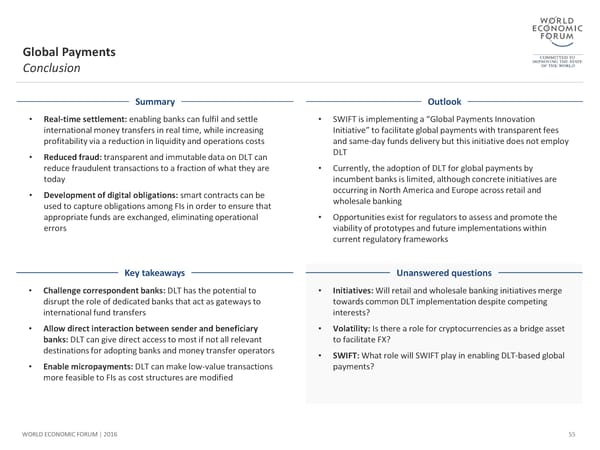

Global Payments Conclusion Summary Outlook • Real-time settlement: enabling banks can fulfil and settle • SWIFT is implementing a “Global Payments Innovation international money transfers in real time, while increasing Initiative” to facilitate global payments with transparent fees profitability via a reduction in liquidity and operations costs and same-day funds delivery but this initiative does not employ • Reduced fraud: transparentand immutable data on DLT can DLT reduce fraudulent transactions to a fraction of what they are • Currently, the adoption of DLT for global payments by today incumbent banks is limited, although concrete initiatives are • Development of digital obligations: smart contracts can be occurring in North America and Europe across retail and used to capture obligations among FIs in order to ensure that wholesale banking appropriate funds are exchanged, eliminating operational • Opportunities exist for regulators to assess and promote the errors viability of prototypes and future implementations within current regulatory frameworks Key takeaways Unanswered questions • Challenge correspondent banks: DLT has the potential to • Initiatives: Will retail and wholesale banking initiatives merge disrupt the role of dedicated banks that act as gateways to towards common DLT implementation despite competing international fund transfers interests? • Allow direct interaction between sender and beneficiary • Volatility: Is there a role for cryptocurrencies as a bridge asset banks: DLT can give direct access to most if not all relevant to facilitate FX? destinations for adopting banks and money transfer operators • SWIFT: What role will SWIFT play in enabling DLT-based global • Enable micropayments: DLT can make low-value transactions payments? more feasible to FIs as cost structures are modified WORLD ECONOMIC FORUM | 2016 55

The Future of Financial Infrastructure Page 54 Page 56

The Future of Financial Infrastructure Page 54 Page 56