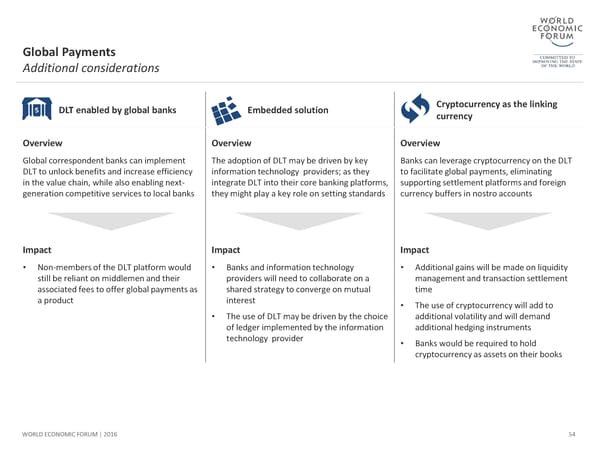

Global Payments Additional considerations DLT enabled by global banks Embedded solution Cryptocurrencyas the linking currency Overview Overview Overview Global correspondent banks can implement The adoption of DLT may be driven by key Banks can leverage cryptocurrency on the DLT DLT to unlock benefits and increase efficiency informationtechnology providers; as they to facilitate global payments, eliminating in the value chain, while also enabling next- integrate DLT into their core banking platforms, supporting settlement platforms and foreign generation competitive services to local banks they might play a key role on setting standards currency buffers in nostro accounts Impact Impact Impact • Non-members of the DLT platform would • Banks and informationtechnology • Additional gains will be made on liquidity still be reliant on middlemen and their providers will need to collaborate on a management and transaction settlement associated fees to offer global payments as shared strategy to converge on mutual time a product interest • The use of cryptocurrency will add to • The use of DLT may be driven by the choice additional volatility and will demand of ledger implemented by the information additional hedging instruments technology provider • Banks would be required to hold cryptocurrency as assets on their books WORLD ECONOMIC FORUM | 2016 54

The Future of Financial Infrastructure Page 53 Page 55

The Future of Financial Infrastructure Page 53 Page 55