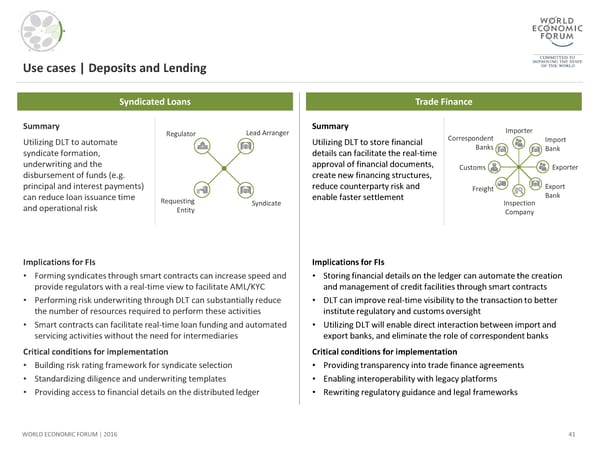

Use cases | Deposits and Lending Syndicated Loans Trade Finance Summary Regulator Lead Arranger Summary Importer Utilizing DLT to automate Utilizing DLT to store financial Correspondent Import syndicate formation, details can facilitate the real-time Banks Bank underwriting and the approval of financial documents, Customs Exporter disbursement of funds (e.g. create new financing structures, principal and interest payments) reduce counterparty risk and Freight Export can reduce loan issuance time Requesting enable faster settlement Bank and operational risk Entity Syndicate Inspection Company Implications for FIs Implications for FIs • Forming syndicates through smart contracts can increase speed and • Storing financial details on the ledger can automate the creation provide regulators with a real-time view to facilitate AML/KYC and management of credit facilities through smart contracts • Performing risk underwriting through DLT can substantially reduce • DLT can improve real-time visibility to the transaction to better the number of resources required to perform these activities institute regulatory and customs oversight • Smart contracts can facilitate real-time loan funding and automated • Utilizing DLT will enable direct interaction between import and servicing activities without the need for intermediaries export banks, and eliminate the role of correspondent banks Critical conditions for implementation Critical conditions for implementation • Building risk rating framework for syndicate selection • Providing transparency into trade finance agreements • Standardizing diligence and underwriting templates • Enabling interoperability with legacy platforms • Providing access to financial details on the distributed ledger • Rewriting regulatory guidance and legal frameworks WORLD ECONOMIC FORUM | 2016 41

The Future of Financial Infrastructure Page 40 Page 42

The Future of Financial Infrastructure Page 40 Page 42