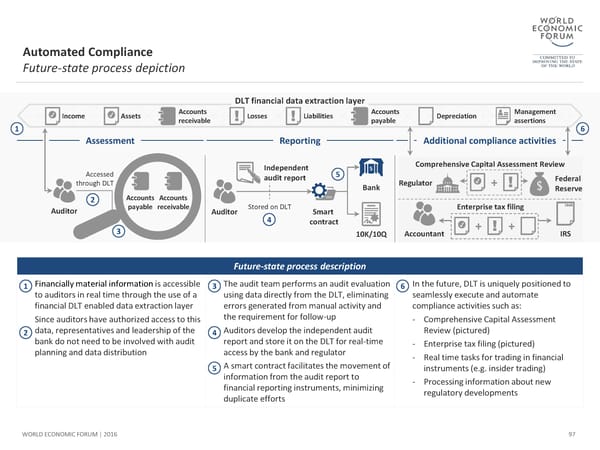

Automated Compliance Future-state process depiction DLT financial data extraction layer Income Assets Accounts Losses Liabilities Accounts Depreciation Management receivable payable assertions 1 6 Assessment Reporting Additional compliance activities Independent Comprehensive Capital Assessment Review Accessed audit report 5 Federal through DLT Bank Regulator + Reserve 2 Accounts Accounts Auditor payable receivable Auditor Stored on DLT Smart Enterprise tax filing 4 contract + + 3 10K/10Q Accountant IRS Future-state process description 1 Financially material information is accessible 3 Theauditteam performs an audit evaluation 6 Inthe future, DLT is uniquely positioned to to auditors in real time through the use of a using data directly from the DLT, eliminating seamlessly execute and automate financial DLT enabled data extraction layer errors generated from manual activity and compliance activities such as: Since auditors have authorized access to this the requirement for follow-up - Comprehensive Capital Assessment 2 data, representatives and leadership of the 4 Auditors develop the independent audit Review (pictured) bank do not need to be involved with audit report and store it on the DLT for real-time - Enterprise tax filing (pictured) planning and data distribution access by the bank and regulator - Real time tasks for trading in financial 5 A smart contract facilitates the movement of instruments (e.g. insider trading) information from the audit report to - Processing information about new financial reporting instruments, minimizing regulatory developments duplicate efforts WORLD ECONOMIC FORUM | 2016 97

The Future of Financial Infrastructure Page 96 Page 98

The Future of Financial Infrastructure Page 96 Page 98