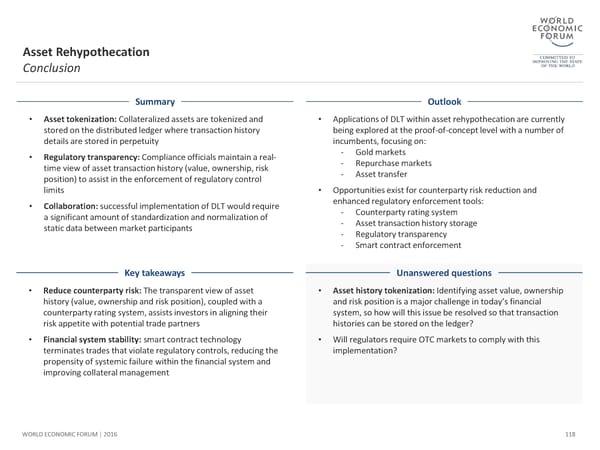

Asset Rehypothecation Conclusion Summary Outlook • Asset tokenization: Collateralized assets are tokenized and • Applications of DLT within asset rehypothecation are currently stored on the distributed ledger where transaction history being explored at the proof-of-concept level with a number of details are stored in perpetuity incumbents, focusing on: • Regulatory transparency:Compliance officials maintain a real- - Gold markets time view of asset transaction history (value, ownership, risk - Repurchase markets position) to assist in the enforcement of regulatory control - Asset transfer limits • Opportunities exist for counterparty risk reduction and • Collaboration: successful implementation of DLT would require enhanced regulatory enforcement tools: a significant amount of standardization and normalization of - Counterparty rating system static data between market participants - Asset transaction history storage - Regulatory transparency - Smart contract enforcement Key takeaways Unanswered questions • Reduce counterparty risk:The transparent view of asset • Asset history tokenization: Identifying asset value, ownership history (value, ownership and risk position), coupled with a and risk position is a major challenge in today’s financial counterparty rating system, assists investors in aligning their system, so how will this issue be resolved so that transaction risk appetite with potential trade partners histories can be stored on the ledger? • Financial system stability: smart contract technology • Will regulators require OTC markets to comply with this terminates trades that violate regulatory controls, reducing the implementation? propensity of systemic failure within the financial system and improving collateral management WORLD ECONOMIC FORUM | 2016 118

The Future of Financial Infrastructure Page 117 Page 119

The Future of Financial Infrastructure Page 117 Page 119