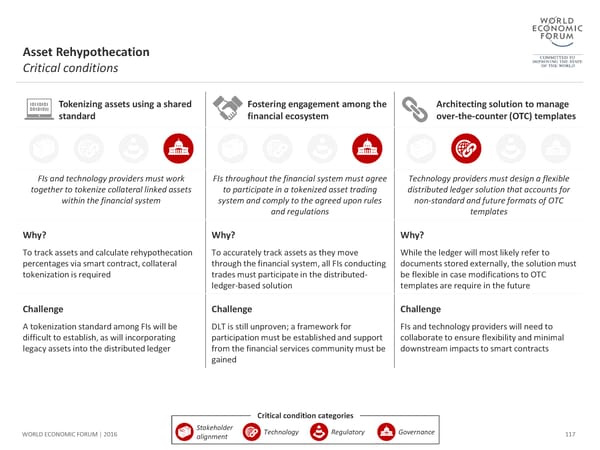

Asset Rehypothecation Critical conditions Tokenizing assets using a shared Fostering engagement among the Architecting solution to manage standard financial ecosystem over-the-counter (OTC) templates FIs and technology providers must work FIs throughout the financial system must agree Technology providers must design a flexible together to tokenize collateral linked assets to participate in a tokenized asset trading distributed ledger solution that accounts for within the financial system system and comply to the agreed upon rules non-standard and future formats of OTC and regulations templates Why? Why? Why? To track assets and calculate rehypothecation To accurately track assets as they move While the ledger will most likely refer to percentages via smart contract, collateral through the financial system, all FIs conducting documents stored externally, the solution must tokenization is required trades must participate in the distributed- be flexible in case modifications to OTC ledger-based solution templates are require in the future Challenge Challenge Challenge A tokenization standard among FIs will be DLT is still unproven; a framework for FIs and technology providers will need to difficult to establish, as will incorporating participation must be established and support collaborate to ensure flexibility and minimal legacy assets into the distributed ledger from the financial services community must be downstream impacts to smart contracts gained Critical condition categories WORLD ECONOMIC FORUM | 2016 Stakeholder Technology Regulatory Governance 117 alignment

The Future of Financial Infrastructure Page 116 Page 118

The Future of Financial Infrastructure Page 116 Page 118