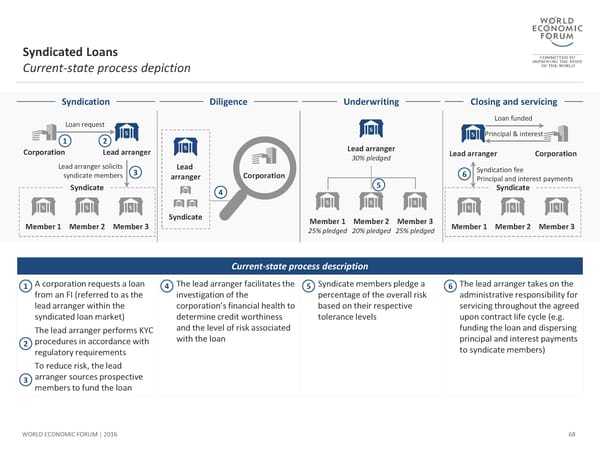

Syndicated Loans Current-state process depiction Syndication Diligence Underwriting Closing and servicing Loan request Loan funded 1 2 Principal & interest Corporation Lead arranger Lead arranger Lead arranger Corporation 30% pledged Lead arranger solicits 3 Lead 6 Syndication fee syndicate members arranger Corporation Principal and interest payments Syndicate 4 5 Syndicate Syndicate Member 1 Member 2 Member 3 Member 1 Member 2 Member 3 25% pledged 20% pledged 25% pledged Member 1 Member 2 Member 3 Current-state process description 1 A corporation requests a loan 4 The lead arranger facilitates the 5 Syndicate memberspledge a 6 The lead arranger takes on the from an FI (referred to as the investigationof the percentage of the overall risk administrative responsibility for lead arranger withinthe corporation’s financial health to based on their respective servicing throughout the agreed syndicated loan market) determine credit worthiness tolerance levels upon contract life cycle (e.g. The lead arranger performs KYC and the level of risk associated funding the loan and dispersing 2 procedures in accordance with with the loan principal and interest payments regulatory requirements to syndicate members) To reduce risk, the lead 3 arranger sources prospective members to fund the loan WORLD ECONOMIC FORUM | 2016 68

The Future of Financial Infrastructure Page 67 Page 69

The Future of Financial Infrastructure Page 67 Page 69