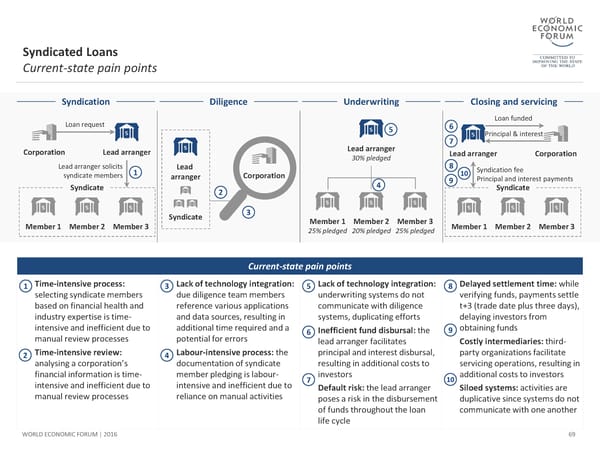

Syndicated Loans Current-state pain points Syndication Diligence Underwriting Closing and servicing Loan request 6 Loan funded 5 Principal & interest Lead arranger 7 Corporation Lead arranger 30% pledged Lead arranger Corporation Lead arranger solicits 1 Lead 8 10 Syndication fee syndicate members arranger Corporation 9 Principal and interest payments Syndicate 2 4 Syndicate Syndicate 3 Member 1 Member 2 Member 3 Member 1 Member 2 Member 3 Member 1 Member 2 Member 3 25% pledged 20% pledged 25% pledged Current-state pain points 1 Time-intensive process: 3 Lack of technology integration: 5 Lack of technology integration: 8 Delayed settlement time: while selecting syndicate members due diligence team members underwriting systems do not verifying funds, payments settle based on financial health and reference various applications communicate with diligence t+3 (trade date plus three days), industry expertise is time- and data sources, resulting in systems, duplicating efforts delaying investors from intensive and inefficient due to additional time required and a 6 Inefficient fund disbursal: the 9 obtaining funds manual review processes potential for errors lead arranger facilitates Costly intermediaries: third- 2 Time-intensive review: 4 Labour-intensive process: the principal and interest disbursal, party organizations facilitate analysing a corporation’s documentation of syndicate resulting in additional costs to servicing operations, resulting in financial information is time- member pledging is labour- 7 investors 10 additional costs to investors intensive and inefficient due to intensive and inefficient due to Default risk: the lead arranger Siloed systems: activities are manual review processes reliance on manual activities poses a risk in the disbursement duplicative since systems do not of funds throughout the loan communicate with one another life cycle WORLD ECONOMIC FORUM | 2016 69

The Future of Financial Infrastructure Page 68 Page 70

The Future of Financial Infrastructure Page 68 Page 70