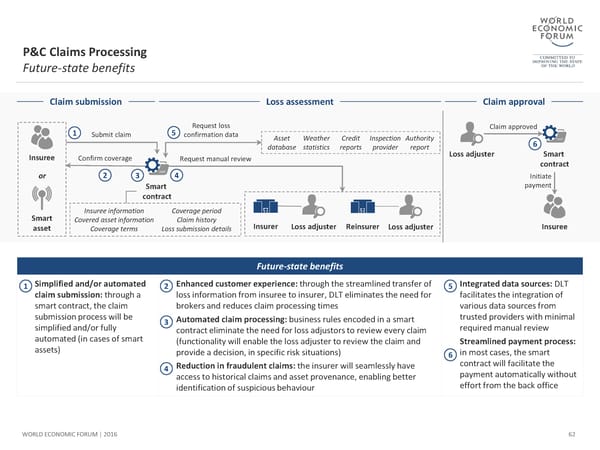

P&C Claims Processing Future-state benefits Claim submission Loss assessment Claim approval 1 5 Request loss Claim approved Submit claim confirmation data Asset Weather Credit Inspection Authority database statistics reports provider report 6 Insuree Confirm coverage Request manual review Loss adjuster Smart contract or 2 3 4 Initiate Smart payment contract Smart Insuree information Coverage period Covered asset information Claim history Insurer Loss adjuster Reinsurer Loss adjuster Insuree asset Coverage terms Loss submission details Future-state benefits 1 Simplified and/or automated 2 Enhanced customer experience: through the streamlined transfer of 5 Integrateddata sources: DLT claim submission: through a loss information from insuree to insurer, DLT eliminates the need for facilitates the integration of smart contract, the claim brokers and reduces claim processing times various data sources from submission process will be 3 Automated claim processing: business rules encoded in a smart trusted providers with minimal simplified and/or fully contract eliminate the need for loss adjustors to review every claim required manual review automated (in cases of smart (functionality will enable the loss adjuster to review the claim and Streamlined payment process: assets) provide a decision, in specific risk situations) 6 in most cases, the smart 4 Reduction in fraudulent claims: the insurer will seamlessly have contract will facilitate the access to historical claims and asset provenance, enabling better payment automatically without identification of suspicious behaviour effort from the back office WORLD ECONOMIC FORUM | 2016 62

The Future of Financial Infrastructure Page 61 Page 63

The Future of Financial Infrastructure Page 61 Page 63