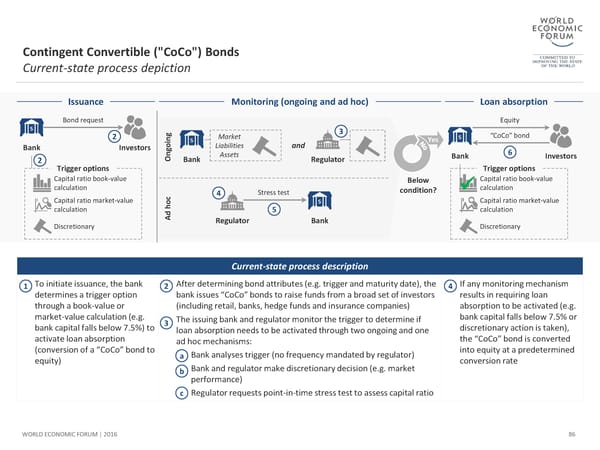

Contingent Convertible ("CoCo") Bonds Current-state process depiction Issuance Monitoring (ongoing and ad hoc) Loan absorption Bond request Equity g 3 2 oin Market Yes “CoCo” bond Bank Investors g Liabilities and 6 2 On Bank Assets Regulator Bank Investors Trigger options Trigger options Capital ratio book-value Below Capital ratio book-value calculation calculation c 4 Stress test condition? Capital ratio market-value ho Capital ratio market-value calculation Ad 5 calculation Discretionary Regulator Bank Discretionary Current-state process description 1 To initiate issuance, the bank 2 After determining bond attributes (e.g. trigger and maturity date), the 4 If any monitoringmechanism determines a trigger option bank issues “CoCo” bonds to raise funds from a broad set of investors results in requiring loan through a book-value or (including retail, banks, hedge funds and insurance companies) absorption to be activated (e.g. market-value calculation(e.g. 3 The issuing bank and regulator monitor the trigger to determine if bank capital falls below 7.5% or bank capital falls below 7.5%) to loan absorption needs to be activated through two ongoing and one discretionary action is taken), activate loan absorption ad hoc mechanisms: the “CoCo” bond is converted (conversion of a “CoCo” bond to - Bank analyses trigger (no frequency mandated by regulator) into equity at a predetermined equity) a conversion rate - Bank and regulator make discretionary decision (e.g. market b performance) - Regulator requests point-in-time stress test to assess capital ratio c WORLD ECONOMIC FORUM | 2016 86

The Future of Financial Infrastructure Page 85 Page 87

The Future of Financial Infrastructure Page 85 Page 87