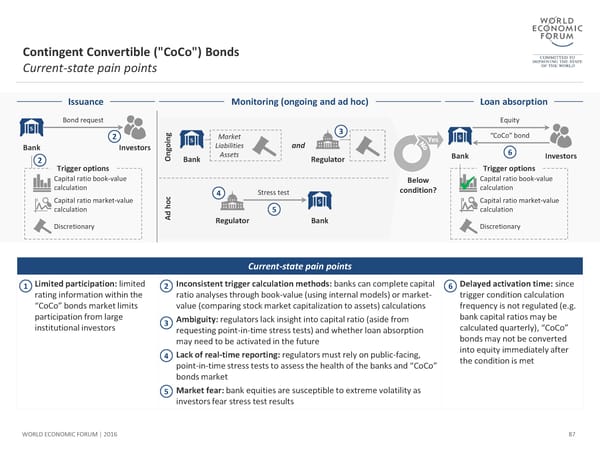

Contingent Convertible ("CoCo") Bonds Current-state pain points Issuance Monitoring (ongoing and ad hoc) Loan absorption Bond request Equity g 3 2 oin Market Yes “CoCo” bond Bank Investors g Liabilities and 6 2 On Bank Assets Regulator Bank Investors Trigger options Trigger options Capital ratio book-value Below Capital ratio book-value calculation calculation c 4 Stress test condition? Capital ratio market-value ho Capital ratio market-value calculation Ad 5 calculation Discretionary Regulator Bank Discretionary Current-state pain points 1 Limited participation: limited 2 Inconsistent trigger calculation methods: banks can complete capital 6 Delayed activation time: since rating information within the ratio analyses through book-value (using internal models) or market- trigger conditioncalculation “CoCo” bonds market limits value (comparing stock market capitalization to assets) calculations frequency is not regulated (e.g. participationfrom large 3 Ambiguity: regulators lack insight into capital ratio (aside from bank capital ratios may be institutional investors requesting point-in-time stress tests) and whether loan absorption calculated quarterly), “CoCo” may need to be activated in the future bonds may not be converted 4 Lack of real-time reporting: regulators must rely on public-facing, into equity immediately after point-in-time stress tests to assess the health of the banks and “CoCo” the condition is met bonds market 5 Market fear: bank equities are susceptible to extreme volatility as investors fear stress test results WORLD ECONOMIC FORUM | 2016 87

The Future of Financial Infrastructure Page 86 Page 88

The Future of Financial Infrastructure Page 86 Page 88