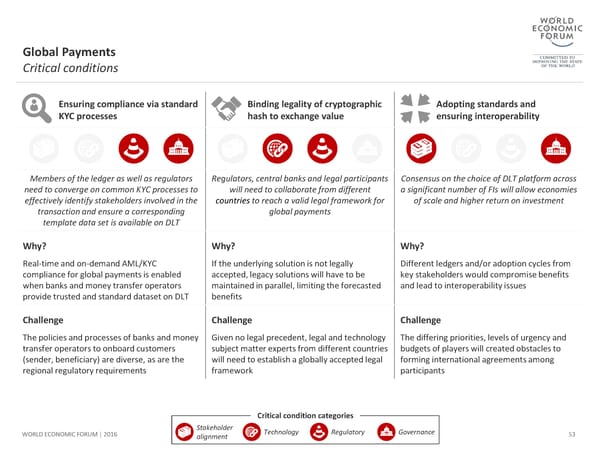

Global Payments Critical conditions Ensuring compliance via standard Binding legality of cryptographic Adoptingstandards and KYC processes hash to exchange value ensuring interoperability Members of the ledger as well as regulators Regulators, central banks and legal participants Consensus on the choice of DLT platform across need to converge on common KYC processes to will need to collaborate from different a significant number of FIs will allow economies effectively identify stakeholders involved in the countries to reach a valid legal framework for of scale and higher return on investment transaction and ensure a corresponding global payments template data set is available on DLT Why? Why? Why? Real-time and on-demand AML/KYC If the underlying solution is not legally Different ledgers and/or adoption cycles from compliance for global payments is enabled accepted, legacy solutions will have to be key stakeholders would compromise benefits when banksand money transfer operators maintained in parallel, limiting the forecasted and lead to interoperability issues provide trusted and standard dataset on DLT benefits Challenge Challenge Challenge The policies and processes of banks and money Given no legal precedent, legal and technology The differing priorities, levels of urgency and transfer operatorsto onboard customers subject matter experts from different countries budgets of players will created obstacles to (sender, beneficiary) are diverse, as are the will need to establish a globally accepted legal forminginternational agreements among regional regulatory requirements framework participants Critical condition categories WORLD ECONOMIC FORUM | 2016 Stakeholder Technology Regulatory Governance 53 alignment

The Future of Financial Infrastructure Page 52 Page 54

The Future of Financial Infrastructure Page 52 Page 54