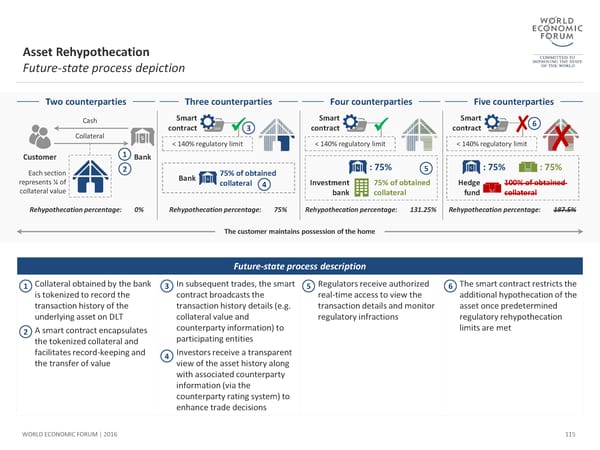

Asset Rehypothecation Future-state process depiction Two counterparties Three counterparties Four counterparties Five counterparties Cash Smart Smart Smart 6 contract 3 contract contract ✘ Collateral < 140% regulatory limit < 140% regulatory limit < 140% regulatory limit ✘ Customer 1 Bank Each section 2 75% of obtained : 75% 5 : 75% : 75% represents ¼ of Bank collateral 4 Investment 75% of obtained Hedge 100% of obtained collateral value bank collateral fund collateral Rehypothecation percentage: 0% Rehypothecation percentage: 75% Rehypothecation percentage: 131.25% Rehypothecation percentage: 187.5% The customer maintains possession of the home Future-state process description 1 Collateral obtained by the bank 3 In subsequent trades, the smart 5 Regulators receive authorized 6 The smart contract restricts the is tokenized to record the contract broadcasts the real-time access to view the additionalhypothecation of the transaction history of the transaction history details (e.g. transaction details and monitor asset once predetermined underlying asset on DLT collateral value and regulatory infractions regulatory rehypothecation 2 A smartcontract encapsulates counterparty information) to limits are met the tokenized collateral and participating entities facilitates record-keeping and 4 Investors receive a transparent the transfer of value view of the asset history along with associated counterparty information (via the counterparty rating system) to enhance trade decisions WORLD ECONOMIC FORUM | 2016 115

The Future of Financial Infrastructure Page 114 Page 116

The Future of Financial Infrastructure Page 114 Page 116