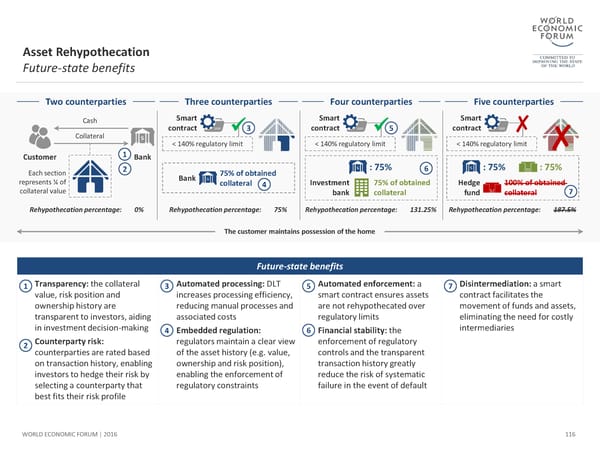

Asset Rehypothecation Future-state benefits Two counterparties Three counterparties Four counterparties Five counterparties Cash Smart Smart Smart contract 3 contract 5 contract ✘ Collateral < 140% regulatory limit < 140% regulatory limit < 140% regulatory limit ✘ Customer 1 Bank Each section 2 75% of obtained : 75% 6 : 75% : 75% represents ¼ of Bank collateral 4 Investment 75% of obtained Hedge 100% of obtained collateral value bank collateral fund collateral 7 Rehypothecation percentage: 0% Rehypothecation percentage: 75% Rehypothecation percentage: 131.25% Rehypothecation percentage: 187.5% The customer maintains possession of the home Future-state benefits 1 Transparency: thecollateral 3 Automated processing: DLT 5 Automated enforcement: a 7 Disintermediation: a smart value, risk position and increases processingefficiency, smart contract ensures assets contract facilitates the ownershiphistory are reducing manual processes and are not rehypothecated over movement of funds and assets, transparent to investors, aiding associated costs regulatory limits eliminating the need for costly in investment decision-making 4 Embedded regulation: 6 Financialstability: the intermediaries 2 Counterparty risk: regulators maintain a clear view enforcement of regulatory counterparties are rated based of the asset history (e.g. value, controls and the transparent on transaction history, enabling ownership and risk position), transaction history greatly investors to hedge their risk by enabling the enforcement of reduce the risk of systematic selecting a counterparty that regulatory constraints failure in the event of default best fits their risk profile WORLD ECONOMIC FORUM | 2016 116

The Future of Financial Infrastructure Page 115 Page 117

The Future of Financial Infrastructure Page 115 Page 117