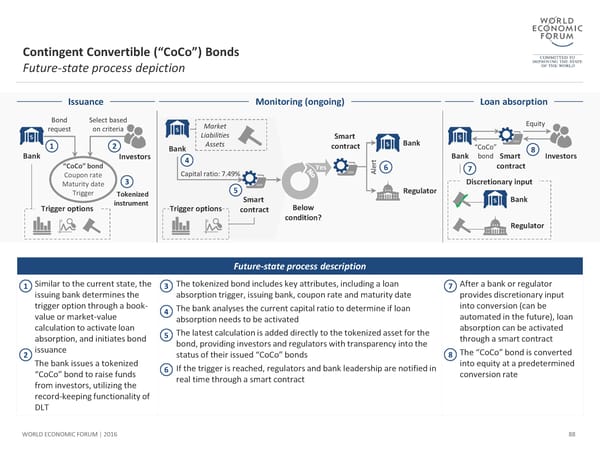

Contingent Convertible (“CoCo”) Bonds Future-state process depiction Issuance Monitoring (ongoing) Loan absorption Bond Select based Market Equity request on criteria Liabilities Smart 1 2 Assets contract Bank Bank “CoCo” 8 Bank Investors 4 rt Bank bond Smart Investors “CoCo” bond Capital ratio: 7.49% Yes Ale6 7 contract Coupon rate 3 Discretionary input Maturity date 5 Regulator Trigger Tokenized Smart Bank instrument Trigger options Trigger options contract Below condition? Regulator Future-state process description 1 Similar to the current state, the 3 The tokenized bond includes key attributes, including a loan 7 After a bank or regulator issuing bank determines the absorption trigger, issuing bank, coupon rate and maturity date provides discretionaryinput trigger option through a book- 4 The bank analyses the current capital ratio to determine if loan into conversion (can be value or market-value absorption needs to be activated automated in the future), loan calculation to activate loan 5 The latest calculation is added directly to the tokenized asset for the absorption can be activated absorption, and initiates bond bond, providing investors and regulators with transparency into the through a smart contract issuance 2 status of their issued “CoCo” bonds 8 The “CoCo” bond is converted The bank issues a tokenized 6 If the trigger is reached, regulators and bank leadership are notified in into equity at a predetermined “CoCo” bond to raise funds real time through a smart contract conversion rate from investors, utilizing the record-keeping functionality of DLT WORLD ECONOMIC FORUM | 2016 88

The Future of Financial Infrastructure Page 87 Page 89

The Future of Financial Infrastructure Page 87 Page 89