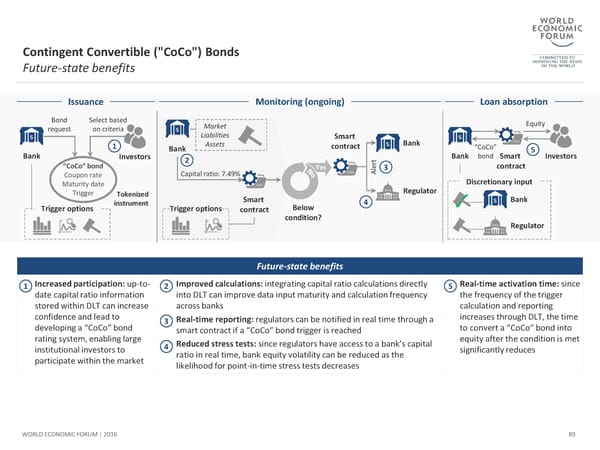

Contingent Convertible ("CoCo") Bonds Future-state benefits Issuance Monitoring (ongoing) Loan absorption Bond Select based Market Equity request on criteria Liabilities Smart 1 Assets contract Bank Bank “CoCo” 5 Bank Investors 2 rt Bank bond Smart Investors “CoCo” bond Capital ratio: 7.49% Yes Ale3 contract Coupon rate Discretionary input Maturity date Regulator Trigger Tokenized Smart Bank instrument 4 Trigger options Trigger options contract Below condition? Regulator Future-state benefits 1 Increased participation: up-to- 2 Improved calculations: integrating capital ratio calculations directly 5 Real-time activation time: since date capital ratio information into DLT can improve data input maturity and calculation frequency the frequency of the trigger stored within DLT can increase across banks calculation and reporting confidence and lead to 3 Real-time reporting: regulators can be notified in real time through a increases through DLT, the time developing a “CoCo” bond to convert a “CoCo” bond into rating system, enabling large smart contract if a “CoCo” bond trigger is reached equity after the condition is met institutional investors to 4 Reduced stress tests: since regulators have access to a bank’s capital significantly reduces participate within the market ratio in real time, bank equity volatility can be reduced as the likelihood for point-in-time stress tests decreases WORLD ECONOMIC FORUM | 2016 89

The Future of Financial Infrastructure Page 88 Page 90

The Future of Financial Infrastructure Page 88 Page 90