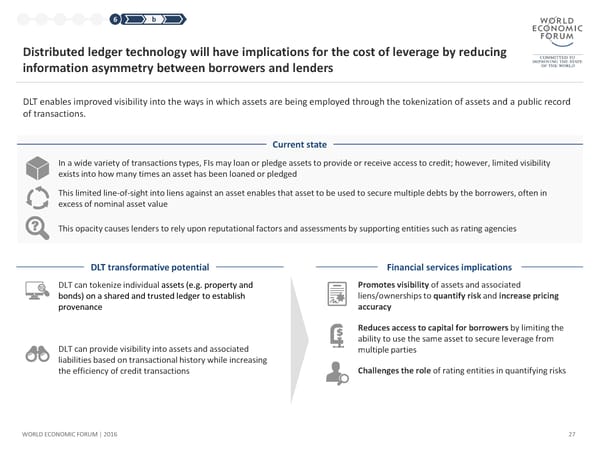

1 2 3 4 5 6 b Distributed ledger technology will have implications for the cost of leverage by reducing information asymmetry between borrowers and lenders DLT enables improved visibility into the ways in which assets are being employed through the tokenization of assets and a public record of transactions. Current state In a wide variety of transactions types, FIs may loan or pledge assets to provide or receive access to credit; however, limited visibility exists into how many times an asset has been loaned or pledged This limited line-of-sight into liens against an asset enables that asset to be used to secure multiple debts by the borrowers, often in excess of nominal asset value This opacity causes lenders to rely upon reputational factors and assessments by supporting entities such as rating agencies DLT transformative potential Financial services implications DLT can tokenize individual assets (e.g. property and Promotes visibility of assets and associated bonds) on a shared and trusted ledger to establish liens/ownerships to quantify risk and increase pricing provenance accuracy Reduces access to capital for borrowers by limiting the ability to use the same asset to secure leverage from DLT can provide visibility into assets and associated multiple parties liabilities based on transactional history while increasing the efficiency of credit transactions Challenges the role of rating entities in quantifying risks WORLD ECONOMIC FORUM | 2016 27

The Future of Financial Infrastructure Page 26 Page 28

The Future of Financial Infrastructure Page 26 Page 28