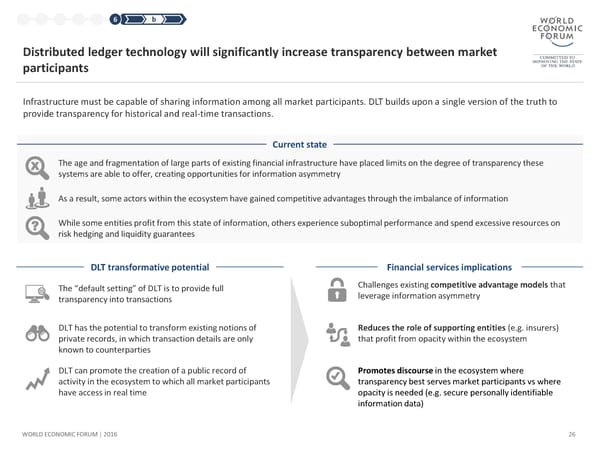

1 2 3 4 5 6 b Distributed ledger technology will significantly increase transparency between market participants Infrastructure must be capable of sharing information among all market participants. DLT builds upon a single version of the truth to provide transparency for historical and real-time transactions. Current state The age and fragmentation of large parts of existing financial infrastructure have placed limits on the degree of transparency these systems are able to offer, creating opportunities for information asymmetry As a result, some actors within the ecosystem have gained competitive advantages through the imbalance of information While some entities profit from this state of information, others experience suboptimal performance and spend excessive resources on risk hedging and liquidity guarantees DLT transformative potential Financial services implications The “default setting” of DLT is to provide full Challenges existing competitive advantage models that transparency into transactions leverage information asymmetry DLT has the potential to transform existing notions of Reduces the role of supporting entities (e.g. insurers) private records, in which transaction details are only that profit from opacity within the ecosystem known to counterparties DLT can promote the creation of a public record of Promotes discourse in the ecosystem where activity in the ecosystem to which all market participants transparency best serves market participants vs where have access in real time opacity is needed (e.g. secure personally identifiable information data) WORLD ECONOMIC FORUM | 2016 26

The Future of Financial Infrastructure Page 25 Page 27

The Future of Financial Infrastructure Page 25 Page 27