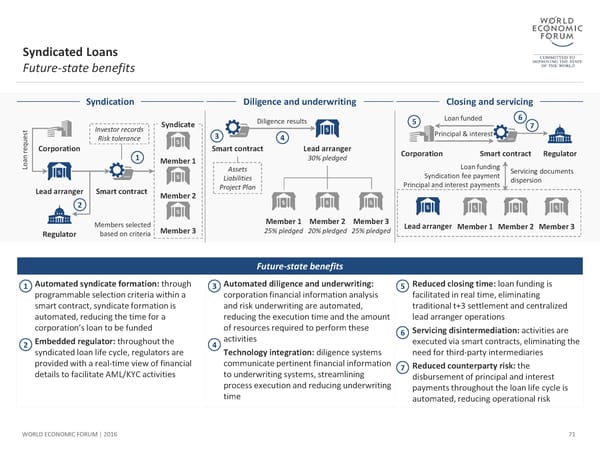

Syndicated Loans Future-state benefits Syndication Diligence and underwriting Closing and servicing Syndicate Diligence results 5 Loan funded 6 7 tes Investor records 3 Principal & interest uq Risk tolerance 4 re Corporation Smart contract Lead arranger Corporation Smart contract Regulator ano 1 Member 1 30% pledged L Assets Loan funding Servicing documents Liabilities Syndication fee payment dispersion Lead arranger Smart contract Project Plan Principal and interest payments Member 2 2 Members selected Member 1 Member 2 Member 3 Lead arranger Member 1 Member 2 Member 3 Regulator based on criteria Member 3 25% pledged 20% pledged 25% pledged Future-state benefits 1 Automated syndicate formation: through 3 Automated diligence and underwriting: 5 Reduced closing time: loan funding is programmable selection criteria within a corporation financial information analysis facilitated in real time, eliminating smart contract, syndicate formation is and risk underwriting are automated, traditional t+3 settlement and centralized automated, reducing the time for a reducing the execution time and the amount lead arranger operations corporation’s loan to be funded of resources required to perform these 6 Servicing disintermediation: activities are 2 Embedded regulator: throughout the 4 activities executed via smart contracts, eliminating the syndicated loan life cycle, regulators are Technology integration: diligence systems need for third-party intermediaries provided with a real-time view of financial communicate pertinent financial information 7 Reducedcounterparty risk: the details to facilitate AML/KYC activities to underwriting systems, streamlining disbursement of principal and interest process execution and reducing underwriting payments throughout the loan life cycle is time automated, reducing operational risk WORLD ECONOMIC FORUM | 2016 71

The Future of Financial Infrastructure Page 70 Page 72

The Future of Financial Infrastructure Page 70 Page 72