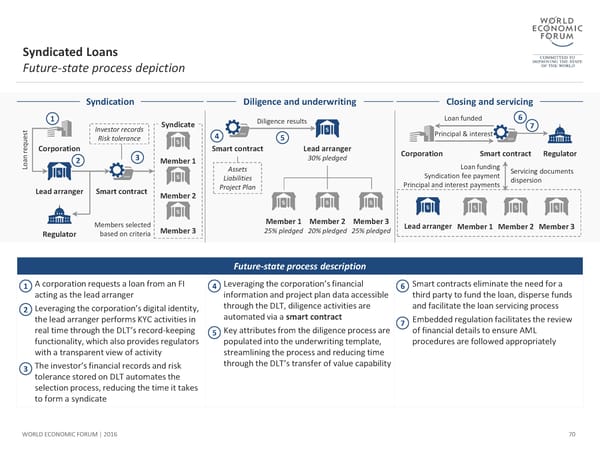

Syndicated Loans Future-state process depiction Syndication Diligence and underwriting Closing and servicing 1 Syndicate Diligence results Loan funded 6 7 tes Investor records 4 Principal & interest uq Risk tolerance 5 re Corporation Smart contract Lead arranger Corporation Smart contract Regulator ano 2 3 Member 1 30% pledged L Assets Loan funding Servicing documents Liabilities Syndication fee payment dispersion Lead arranger Smart contract Project Plan Principal and interest payments Member 2 Members selected Member 1 Member 2 Member 3 Lead arranger Member 1 Member 2 Member 3 Regulator based on criteria Member 3 25% pledged 20% pledged 25% pledged Future-state process description 1 A corporation requests a loan from an FI 4 Leveraging the corporation’s financial 6 Smart contracts eliminate the need for a acting as the lead arranger information and project plan data accessible third party to fund the loan, disperse funds through the DLT, diligence activities are and facilitate the loan servicing process 2 Leveraging the corporation’s digital identity, automated via a smart contract the lead arranger performs KYC activities in 7 Embedded regulation facilitates the review real time through the DLT’s record-keeping 5 Key attributes from the diligence process are of financial details to ensure AML functionality, which also provides regulators populated into the underwriting template, procedures are followed appropriately with a transparent view of activity streamlining the process and reducing time through the DLT’s transfer of value capability 3 The investor’s financial records and risk tolerance stored on DLT automates the selection process, reducing the time it takes to form a syndicate WORLD ECONOMIC FORUM | 2016 70

The Future of Financial Infrastructure Page 69 Page 71

The Future of Financial Infrastructure Page 69 Page 71